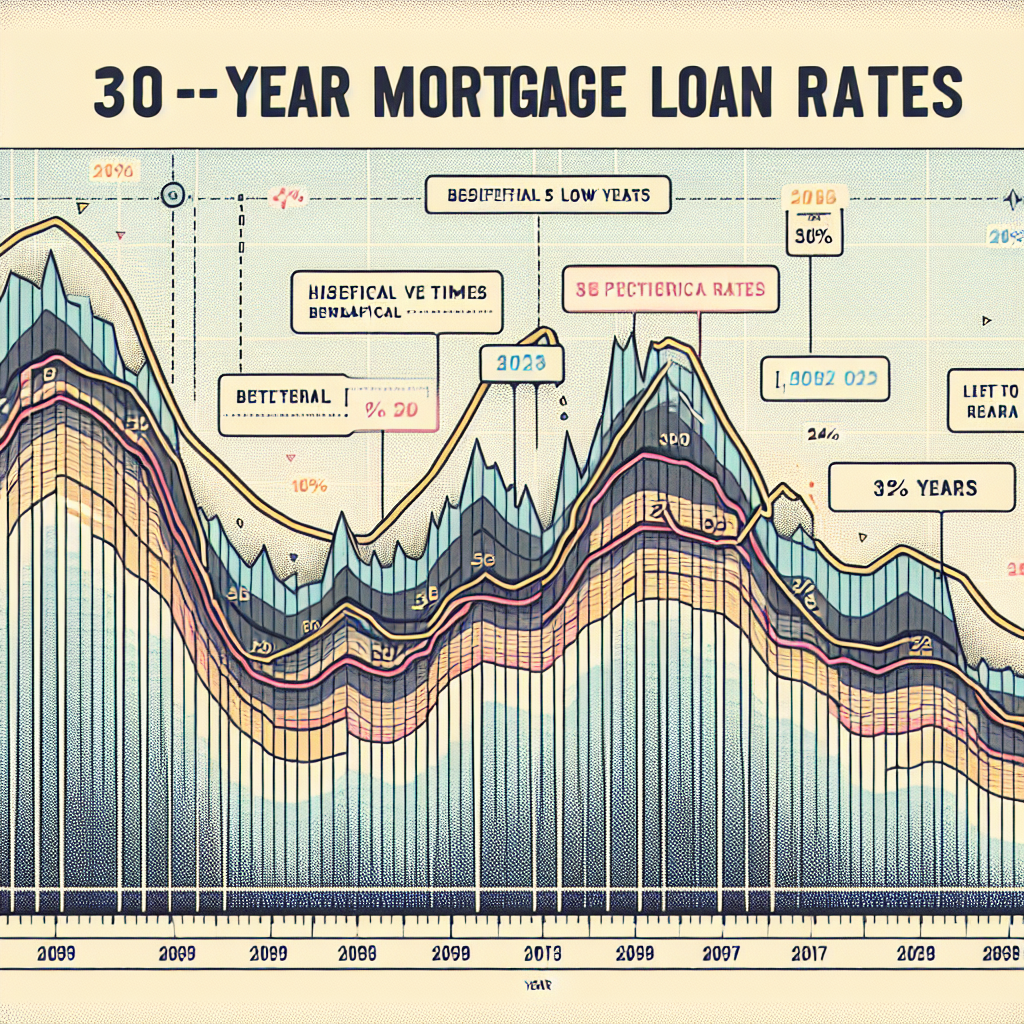

30 year mortgage loan rates

The Long-Term Commitment: Understanding 30-Year Mortgage Loan Rates

For many aspiring homeowners, a mortgage is an essential part of the journey towards owning real estate. Among various loan types, the **30-year mortgage** stands out due to its long-term structure and potentially stable monthly payments. In this article, we will delve into the intricacies of **30-year mortgage loan rates**, examine their implications, and discuss how you can make informed decisions before committing to such a significant financial obligation.

Understanding Mortgage Rates

Before diving into the specifics of 30-year mortgages, it is crucial to understand what mortgage rates are and how they affect your home-buying plans. A mortgage rate is the interest charged on a loan used to purchase a home, and it significantly influences monthly payments and the total amount paid over the life of the loan.

- Fixed Rates: These rates remain constant throughout the loan term. A 30-year fixed-rate mortgage provides predictability in budgeting, as your payment will not fluctuate.

- Adjustable Rates: These rates can change after an initial period, which means your payments may increase or decrease based on the market conditions.

Understanding the type of rate you choose is critical when considering a **30-year mortgage loan**. A fixed-rate offer may be appealing for those who seek stability.

The Benefits of a 30-Year Mortgage

Why would someone opt for a 30-year mortgage? Here are some reasons that might persuade borrowers:

- Lower Monthly Payments: The longer loan term means lower payments compared to shorter-term loans. This can help manage cash flow and allow for other investments.

- Flexibility: With lower monthly payments, borrowers may find it easier to balance their budgets or handle unexpected expenses.

- Opportunity for Home Appreciation: Over three decades, property values may rise, potentially leading to a profit when the home is sold.

The Current Landscape of 30-Year Mortgage Loan Rates

The mortgage market is dynamic and can be influenced by various factors, including economic conditions, inflation, and monetary policy. As of late 2023, prospective homeowners may notice fluctuations in **30-year mortgage loan rates** due to several elements:

Economic Indicators

The overall economy plays a significant role in determining mortgage rates. Important indicators include:

- Unemployment Rates: Higher unemployment can lead to lower rates as the Federal Reserve aims to stimulate economic activity.

- Inflation: When inflation is high, mortgage rates may increase to maintain lenders’ profit margins.

- Consumer Confidence: If consumers feel confident, they may purchase homes, leading to higher demand and potentially increased rates.

Federal Reserve Policies

The Federal Reserve's decisions regarding interest rates also significantly impact mortgage rates:

- When the Fed raises rates to combat inflation, mortgage rates typically rise.

- If the Fed lowers rates to encourage borrowing and spending, mortgage rates may decrease, benefiting prospective homeowners.

Keeping an eye on these indicators can help potential buyers understand the market's ebb and flow.

How to Secure the Best Mortgage Rate

Now that we have explored the factors influencing **30-year mortgage loan rates**, let's discuss strategies to secure the best rate:

- Improve Your Credit Score: Lenders often offer lower rates to borrowers with higher credit scores. Take steps to pay down debts and make on-time payments to enhance your creditworthiness.

- Shop Around: Don’t settle for the first offer. Compare rates from various lenders to ensure you find the most competitive option.

- Consider Points: Some borrowers opt to buy points at closing, which can lower their interest rate. Determine whether this upfront cost aligns with your financial goals.

- Lock your Rate: Once you find a favorable rate, consider locking it in with the lender to protect yourself from potential increases during the loan processing period.

The Pros and Cons of a 30-Year Mortgage

While a 30-year mortgage comes with several advantages, it’s necessary to consider the downsides as well:

Pros

- Affordability: Lower monthly costs make it feasible for many buyers to purchase a home they might not afford with a higher payment scenario.

- Potential for Higher Credit Scores: Paying a consistent mortgage can positively impact your credit score over time.

- Tax Benefits: Mortgage interest is often tax-deductible, which can provide significant savings for homeowners.

Cons

- Long-Term Debt: Committing to a mortgage for 30 years represents a significant long-term financial obligation.

- Higher Interest Paid Over Time: Due to the extended term, you will generally pay more in interest compared to shorter-term loans.

The Bottom Line: Is a 30-Year Mortgage Right for You?

Deciding on a **30-year mortgage loan** is a personal choice that should be made after careful consideration of your financial situation, long-term goals, and current market conditions. Assess the benefits against the potential drawbacks and consider your unique circumstances. Consulting a financial advisor or mortgage expert can also prove invaluable in making an informed decision.

Conclusion

Understanding the landscape of **30-year mortgage loan rates**, the advantages and disadvantages, and how external factors impact these rates can help prospective homeowners make educated decisions. Research, preparation, and strategic planning are essential for securing the best mortgage rate tailored to your needs.

"Knowledge is power, especially when it comes to making significant financial decisions. Equip yourself with information, and you'll find the right mortgage for your home." - Financial Expert

If you are considering purchasing a home, assess your financial health, keep an eye on **30-year mortgage loan rates**, and stay informed on market conditions to make the most of this long-term commitment.

By Guest, Published on September 18th, 2024