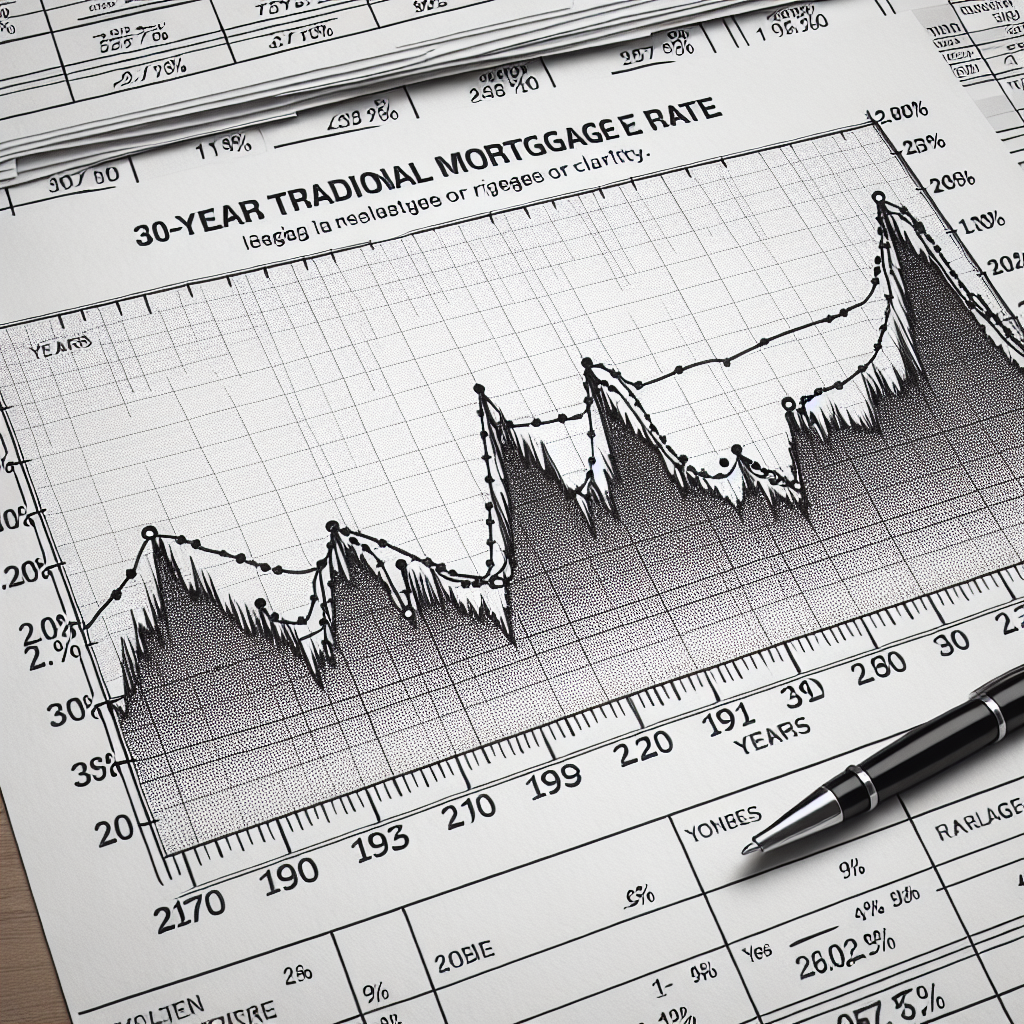

30 year traditional mortgage rate

The Basics of 30-Year Traditional Mortgages

A **30-year traditional mortgage** is a common loan option for homebuyers looking to finance their properties. This type of mortgage allows borrowers to pay off their loan over a period of thirty years, providing a predictable monthly payment throughout the loan's term. This long-term approach makes it easier for individuals or families to budget, as they can anticipate how much they will owe each month without worrying about fluctuating rates.

Understanding Mortgage Rates

Mortgage rates can be influenced by a variety of factors, including economic conditions, inflation, and the decisions made by the Federal Reserve. When considering a **30-year traditional mortgage**, it is essential to understand how these rates can affect the overall cost of homeownership.

- Fixed vs. Adjustable Rates: Fixed-rate mortgages maintain the same interest rate throughout the loan period, which is particularly appealing during times of rising rates. Conversely, adjustable-rate mortgages can fluctuate, often resulting in lower initial payments but uncertainty in the long run.

- Market Influences: Economic indicators, such as employment rates and GDP growth, can impact mortgage interest rates significantly. When the economy is strong, rates often rise, while they tend to decrease during economic downturns.

- Personal Factors: Lenders also consider the borrower's credit score, debt-to-income ratio, and overall financial history when determining rates. Individuals with higher credit scores usually qualify for lower rates.

The Advantages of a 30-Year Loan Term

Choosing a **30-year traditional mortgage** comes with several notable advantages, making it a preferred option for many borrowers. Here are some key benefits:

- Lower Monthly Payments: Spread over thirty years, the total loan balance translates to lower payments compared to shorter loan terms, which can free up cash for other expenses.

- Predictable Payments: Homeowners can easily plan their budgets without worrying about fluctuating payments caused by adjustable rates.

- Potential Tax Deductions: Mortgage interest can often be deducted from taxable income, which may provide further financial relief to homeowners.

Comparing Different Mortgage Options

When applying for a mortgage, it’s important to compare various options available in the market. Here are the main types of mortgages to consider:

- Conventional Loans: These loans are not insured by the government and usually require a credit score of at least 620.

- FHA Loans: Backed by the Federal Housing Administration, these loans offer lower down payment requirements and are popular among first-time homebuyers.

- VA Loans: Available to veterans and active-duty military members, VA loans often come with no down payment and competitive rates.

- USDA Loans: Designed for rural property buyers, these loans offer low-interest rates and no down payment, provided the buyer meets certain income requirements.

Current Trends in 30-Year Mortgage Rates

The **30-year traditional mortgage rate** can fluctuate dramatically based on market conditions. As of mid-2023, rates saw a significant shift due to ongoing economic challenges. Here's a look at some current trends:

- Increased Rates: As inflation concerns persisted, the mortgage rates rose. Borrowers encountered higher rates compared to previous years, impacting affordability and market dynamics.

- Refinancing Surge: Homeowners took advantage of the initial low rates observed in 2020 and 2021, leading to a surge in refinancing activities before rates climbed.

- Impact of Federal Reserve Policies: The Federal Reserve’s monetary policies, especially regarding interest rate hikes, directly influence mortgage rates, making it crucial for borrowers to stay informed.

How to Secure the Best Rate

Securing the best rate for a **30-year traditional mortgage** is essential for long-term savings. Here are some tips to help you get the best deal:

- Improve Your Credit Score: A higher credit score increases the likelihood of securing a lower interest rate. Steps to raise your score include paying down existing debt, ensuring bills are paid on time, and avoiding new credit inquiries.

- Shop Around: Don’t settle for the first lender. Compare quotes from multiple lenders to find the best rates and terms. Make sure to examine all associated fees.

- Consider the Down Payment: A higher down payment can also lead to lower rates. Aim for 20% to avoid private mortgage insurance (PMI).

- Negotiate Fees: Many costs associated with closing can be negotiated. Be sure to ask your lender about potential discounts.

Calculating Monthly Payments

Understanding how to calculate the monthly payments for a mortgage can help prospective homeowners plan their budgets effectively. The formula often used is:

M = P[r(1+r)^n] / [(1+r)^n – 1]

Where:

- M: Monthly payment

- P: Principal loan amount

- r: Monthly interest rate (annual rate divided by 12)

- n: Number of payments (loan term in months)

Using this formula helps borrowers understand how much they will owe each month, allowing them to make informed financial decisions.

Example Calculation

| Loan Amount | Interest Rate | Monthly Payment |

|---|---|---|

| $300,000 | 4.00% | $1,432.25 |

| $400,000 | 4.00% | $1,909.12 |

| $500,000 | 4.00% | $2,386.00 |

The Long-term Commitment of a 30-Year Mortgage

Opting for a **30-year traditional mortgage** involves a long-term commitment. It’s essential for buyers to carefully weigh their options and consider their future plans. Here are factors to keep in mind:

- Life Changes: Consider how life changes, such as job relocations or family expansions, may impact your ability to maintain mortgage payments.

- Market Conditions: Housing markets fluctuate—be mindful of how real estate trends could affect your investment.

- Financial Stability: Ensure your financial history and current earnings support a long-term mortgage commitment.

Conclusion

The **30-year traditional mortgage** remains a popular option for many homebuyers, offering predictable payments and lower monthly costs. While the current market conditions may pose challenges, understanding mortgage rates and how to secure the best terms is crucial for a successful home purchase. Always be proactive in researching, comparing mortgage options, and planning for the long haul to ensure a smoother path to homeownership.

In navigating the complexities of mortgage rates and financing, you can position yourself as an informed consumer, ultimately leading to a more favorable home buying experience. Whether you are a first-time buyer or someone looking to refinance, keeping these points in mind will help you make the best financial decisions possible.

By Guest, Published on October 5th, 2024