Consumer direct loan

Understanding the Consumer Direct Loan: What You Need to Know

In today's financial landscape, understanding the various types of loans available to you is crucial for making informed decisions. One loan option that has gained traction in recent years is the consumer direct loan. This article aims to dissect what a consumer direct loan is, its benefits, drawbacks, and how it fits into the broader picture of personal finance.

What is a Consumer Direct Loan?

A consumer direct loan is a type of financing that allows individuals to directly access funds without relying on traditional banks as intermediaries. This kind of loan is particularly popular among borrowers who seek more control over their borrowing experience and want to simplify the loan process.

The Mechanism Behind Consumer Direct Loans

Consumer direct loans typically involve online lenders or peer-to-peer lending platforms. Borrowers can apply for these loans directly through the lender's website, which streamlines the approval process. This direct-to-consumer model often results in lower fees, competitive interest rates, and faster funding compared to traditional lending avenues.

Types of Consumer Direct Loans

When it comes to consumer direct loans, there are a few types to consider:

- Personal Loans: Unsecured loans that can be used for various purposes, such as debt consolidation, home improvement, or unexpected expenses.

- Auto Loans: Financing options specifically for purchasing vehicles, often with competitive rates due to the value of the collateral.

- Home Equity Loans: Loans where borrowers use their home's equity as collateral, allowing for larger sums at lower interest rates.

Benefits of Consumer Direct Loans

Now that we have a basic understanding of what consumer direct loans are, let’s explore their benefits:

- Simplified Application Process: With online applications, borrowers can complete paperwork from the comfort of their homes.

- Competitive Rates: Many online lenders offer competitive interest rates due to the reduced overhead costs associated with operating online.

- Quick Funding: The average time to receive funding can be significantly shorter than traditional methods, often within a day or two.

- Diverse Offerings: Many lenders provide flexibility in the types of loans available, allowing borrowers to find the right option for their needs.

Drawbacks of Consumer Direct Loans

While the benefits are appealing, it is essential to consider the drawbacks:

- Less Personal Interaction: For individuals who favor face-to-face meetings, the digital-only nature can feel impersonal.

- Potential for High-Interest Rates: Some online lenders may charge higher rates, especially if the borrower has less-than-stellar credit.

- Scams and Fraud: The online lending world can be less regulated, making it easier for predatory lenders to operate. Due diligence is crucial.

How to Choose the Right Lender

Choosing the right lender is vital to ensure a smooth borrowing experience. Here are some steps to guide you:

- Research Lenders: Look at reviews and ratings to gauge customer satisfaction and reliability.

- Compare Rates: Use a loan comparison tool to see different interest rates and terms offered by various lenders.

- Check for Fees: Some lenders may have hidden fees; make sure to read the fine print.

- Verify Licensing: Ensure the lender is licensed to operate in your state to avoid scams.

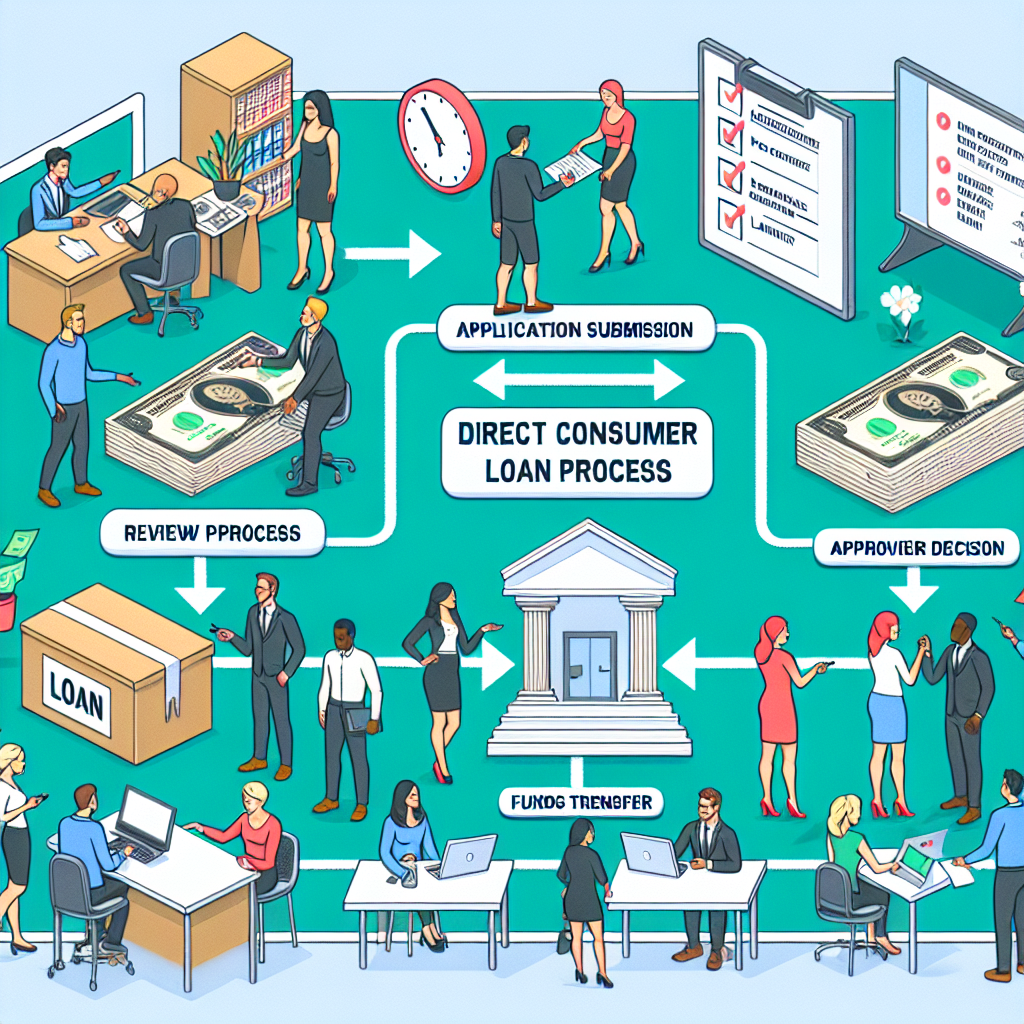

Application Process for Consumer Direct Loans

The application process for consumer direct loans is generally straightforward. Here’s what you can expect:

Step-by-Step Application Guide

- Gather Documents: Prepare your identification, proof of income, and credit history.

- Fill Out the Application: Provide basic personal information, including your financial situation and the loan amount you seek.

- Submit Your Application: Send your completed application via the lender's online platform.

- Review the Offer: Once approved, review the loan terms, including interest rates and repayment schedules.

- Accept the Loan: If the terms are acceptable, finalize your loan agreement and await funding.

Important Considerations

Before opting for a consumer direct loan, it’s essential to keep several important considerations in mind:

- Credit Score: Your credit score significantly influences the interest rate you'll receive. Check your score before applying, and consider improving it if necessary.

- Loan Purpose: Be clear about why you need the loan and how much you require. Borrow only what you can comfortably repay.

- Repayment Plan: Have a solid repayment plan in place to avoid late fees and possible default.

How Consumer Direct Loans Affect Your Credit

Like any type of borrowing, consumer direct loans will affect your credit score. Here are a few impacts to be aware of:

- Credit Inquiry: Applying for a loan will result in a hard inquiry on your credit report, which may temporarily lower your score.

- Credit Utilization: Taking out a loan increases your overall debt, which can affect your credit utilization ratio negatively.

- Payment History: Making timely payments on your loan will improve your credit score over time, while missed payments can severely harm it.

Comparing Consumer Direct Loans with Other Financing Options

To better understand where consumer direct loans stand in the realm of financing, let’s compare them with traditional loans and some alternative financing options:

| Loan Type | Application Process | Interest Rates | Funding Time | Pros | Cons |

|---|---|---|---|---|---|

| Consumer Direct Loan | Online | Competitive | 1-3 days | Convenience, flexibility | Impersonal, potential scams |

| Traditional Bank Loan | In-person | Fixed | 1-2 weeks | Established lenders, often lower rates | Lengthy process, more paperwork |

| Credit Union Loan | In-person or Online | Usually Lower | 1-2 weeks | Member benefits, lower fees | Membership requirements |

| Payday Loan | In-person or Online | Very High | Immediate | Quick access to cash | High interest, debt trap |

Conclusion

To sum up, consumer direct loans offer a modern approach to personal borrowing, facilitating a straightforward option for many. With their simplified application processes and competitive rates, they can be an excellent alternative to traditional loans. However, as with any financial decision, it is crucial to weigh the pros and cons carefully. Conduct thorough research, understand your financial situation, and make informed choices to ensure that you select the loan that best suits your needs.

In the ever-evolving world of finance, staying informed is key. Whether you’re considering a consumer direct loan or exploring other avenues, knowledge is your best asset. Reach out, ask questions, and take control of your financial future!

By Guest, Published on July 26th, 2024